Guide to Mobile Phone Insurance in New Zealand

Mobile phones have become an essential part of our daily lives, offering us convenience, connectivity, and countless functionalities. With the increasing reliance on these devices, protecting them from potential damages and losses has become crucial. This is where mobile phone insurance comes into play. In New Zealand, a wide range of insurance options are available, catering to various needs and budgets. This guide aims to provide comprehensive information about mobile phone insurance in New Zealand, helping you make an informed decision.

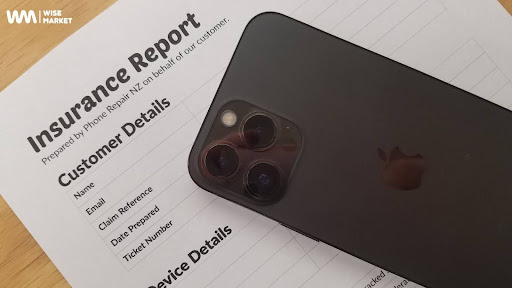

Mobile phones NZ insurance offers coverage for various scenarios, including accidental damage, theft, and loss. Whether you own the latest iPhone or an older model, having insurance can save you from significant financial losses and provide peace of mind. In this article, we will delve into the various aspects of mobile phone insurance, including the types of coverage, benefits, and factors to consider when choosing a policy.

Also Read – Crack the Code: Infinix GT 20 Pro Price in Pakistan Unraveled!

Understanding Mobile Phone Insurance

Mobile phone insurance is designed to protect your device from unexpected events that can lead to damage or loss. The coverage typically includes accidental damage, theft, and loss. Depending on the policy, additional coverage options may be available, such as protection against mechanical breakdowns or water damage.

Types of Coverage

- Accidental Damage: This covers damage caused by unexpected events, such as drops, spills, or other accidents. It is one of the most common types of coverage offered by mobile phone insurance providers.

- Theft: This coverage protects you if your phone is stolen. It often requires proof of theft, such as a police report, to file a claim.

- Loss: Some insurance policies also cover the loss of your phone. This can be particularly useful if you tend to misplace things or if you travel frequently.

- Extended Warranty: Some insurers offer an extended warranty option, which covers mechanical or electrical breakdowns after the manufacturer’s warranty expires.

Benefits of Mobile Phone Insurance

- Financial Protection: The primary benefit of mobile phone insurance is financial protection. Replacing or repairing a damaged or lost phone can be expensive, especially if you own a high-end model. Insurance can help cover these costs, saving you from unexpected expenses.

- Convenience: Many insurance providers offer quick and easy claims processes, allowing you to get your phone repaired or replaced without much hassle.

- Peace of Mind: Knowing that your phone is protected can provide peace of mind, allowing you to use your device without constantly worrying about potential damage or loss.

Factors to Consider When Choosing Mobile Phone Insurance

When selecting a mobile phone insurance policy, several factors should be taken into account to ensure you get the best coverage for your needs.

Coverage Options

Different insurance providers offer varying coverage options. It’s essential to carefully review what each policy includes and excludes. For instance, some policies may not cover water damage, while others might exclude theft. Make sure to choose a policy that covers the scenarios you are most concerned about.

Premiums and Deductibles

The cost of mobile phone insurance can vary widely depending on the coverage, the value of the phone, and the insurer. Be sure to compare premiums and deductibles across different providers. Keep in mind that a lower premium may result in a higher deductible, meaning you’ll pay more out-of-pocket when filing a claim.

Claim Process

Understanding the claims process is crucial. Some insurers offer online claims submissions, while others may require you to call customer service. Check the average turnaround time for claims and read reviews from other customers to gauge the insurer’s reliability.

Exclusions and Limitations

Every insurance policy has exclusions and limitations. These are specific situations or conditions under which the policy will not provide coverage. Common exclusions may include intentional damage, cosmetic damage that does not affect the device’s functionality, and loss due to negligence. Make sure to read the fine print to avoid any surprises when filing a claim.

Additional Benefits

Some insurers offer additional benefits, such as free screen repairs, global coverage, or even discounts on new devices. These perks can add value to your policy and enhance your overall experience.

Top Mobile Phone Insurance Providers in New Zealand

Several reputable insurance providers offer mobile phone insurance in New Zealand. Some of the top names include:

- AMI Insurance: Known for its comprehensive coverage options and competitive premiums, AMI Insurance offers policies that cover accidental damage, theft, and loss.

- State Insurance: Offering flexible coverage options, State Insurance allows customers to tailor their policies to suit their specific needs. They also provide 24/7 customer support, making it easy to file claims.

- Tower Insurance: With a strong reputation for customer service, Tower Insurance offers policies that cover a wide range of scenarios, including accidental damage and theft. They also offer optional extended warranty coverage.

- AA Insurance: Known for its excellent customer service and reliable coverage, AA Insurance offers policies that cover accidental damage, theft, and loss. They also provide discounts for AA members.

Conclusion

In conclusion, mobile phone insurance is an essential consideration for anyone who owns a mobile device in New Zealand. With a wide range of options available, it’s crucial to carefully evaluate the coverage, premiums, and claims process before selecting a policy. Whether you’re concerned about accidental damage, theft, or loss, having the right insurance can provide financial protection and peace of mind.

When searching for the best mobile phone insurance, consider factors such as coverage options, premiums, deductibles, and additional benefits. Remember that the best policy for you will depend on your specific needs and the value of your device.

For those looking for affordable options, it’s worth noting that iPhone prices NZ can vary significantly depending on where you purchase your device. One of the best places to find the lowest prices on mobile phones in New Zealand is Wise Market NZ, known for offering competitive deals on a wide range of devices.